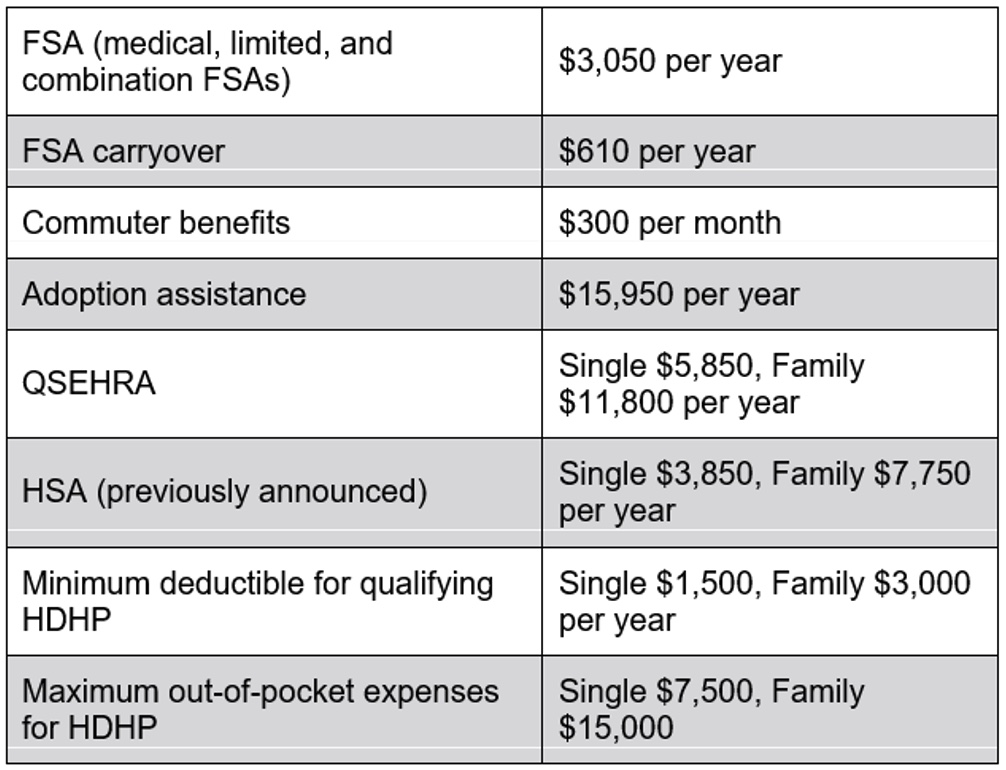

2025 Fsa Contribution Limits Over 50. On october 22, 2025, the irs announced that the limit on employees’ salary reduction contributions to a health flexible spending account (fsa) will increase to $3,3000 for plan. * the indexing formula for health fsa and qualified transportation plan limits is based on the chained consumer price index for all.

Understanding these changes now can help you make. The medical flexible spending account (fsa) contribution limit is $3,300.

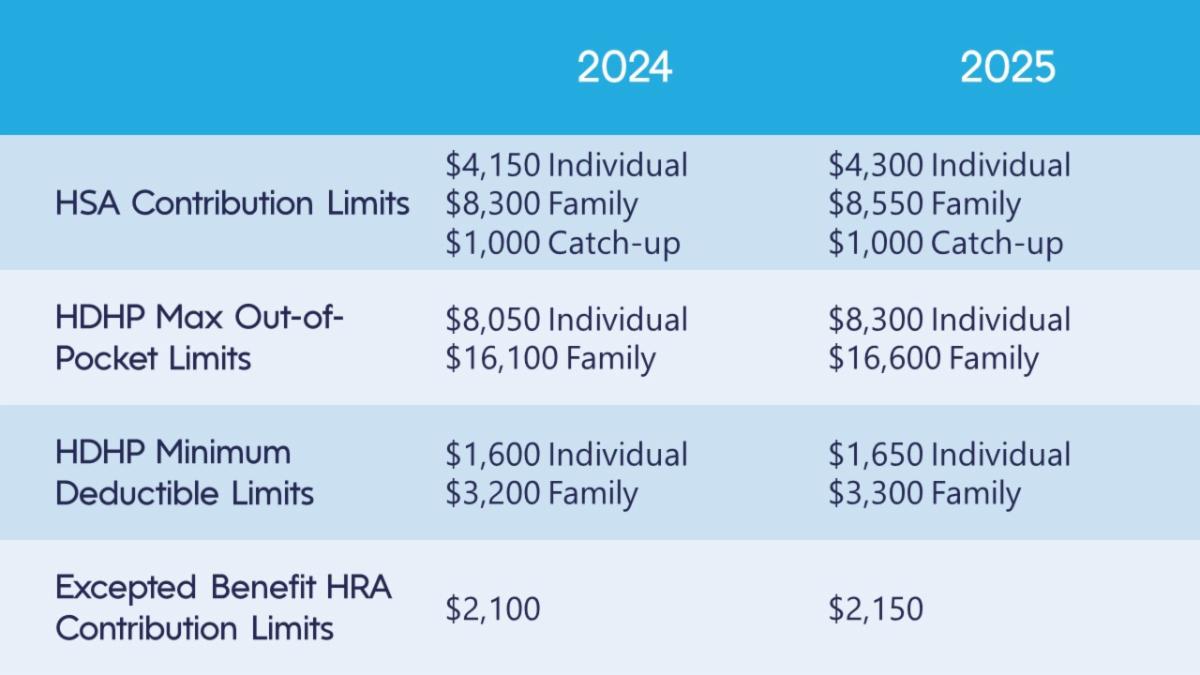

Hsa Limits 2025 Irs Opal Jacquelin, The employee health fsa contribution limits are increasing from $3,200 to $3,300 in 2025.

2025 Hsa Limits Contribution Family Anabel Carmelia, With the new 2025 limit of $3,300, participants can allocate even more toward healthcare costs, reducing their taxable income.

Total 401k Contribution Limit 2025 Over 50 Angela Randall, With the new 2025 limit of $3,300, participants can allocate even more toward healthcare costs, reducing their taxable income.

Hsa Limits Married Filing Jointly 2025 Amye Madlen, The medical flexible spending account (fsa) contribution limit is $3,300.

2025 Hsa Limits Contribution Family Anabel Carmelia, If you have an fsa account, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2026).

Can I Change My Fsa Contribution During The Year 2025 Dixie Sabrina, If you have an fsa account, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2026).

Hsa 2025 Maximum Inkomen Angy Daniela, The irs released 2025 limits for fsas, commuter benefits, adoption assistance, and more.

2025 Hsa Limits Contribution Family Anabel Carmelia, Use this calculator to see how participating in your employer's fsa can help you pay less tax, and increase your net take home pay.

401k And Roth Ira Contribution Limits 2025 Kalender Deeyn Evelina, Monthly contribution for fpl safe harbor.

2025 Hsa Contribution Limits Chart Kaile Marilee, With the new 2025 limit of $3,300, participants can allocate even more toward healthcare costs, reducing their taxable income.